Your Reliable Partner in Game Console Supply

Competitive Prices · Flexible Terms · Long-Term Growth

Global Memory Market Update: DDR4 and NAND Enter a Strong Upcycle, Powered by AI?

Memory prices are surging unexpectedly. DDR4 costs jumped 70% last quarter. AI demand changes everything.

DDR4 prices rose sharply as major producers shift to DDR5 and HBM. NAND also starts climbing with SanDisk's 10% hike. AI servers need 8x more DRAM, fueling this upcycle.

This isn't temporary. The memory market transformation affects every tech business. Let's examine why prices changed so fast and what comes next.

DDR4 Prices Skyrocket: Supply Cuts Widen the Gap?

Your electronics just got more expensive. DDR4 costs nearly doubled since June.

Taiwanese makers Nanya Tech and Winbond raised DDR4 prices 60-70% last quarter. More increases come as global capacity drops to 33% by late 2026.

The DDR4 shortage results from three key factors:

1.Major exits

Samsung, SK Hynix and Micron phased out old DDR4 lines:

- Converted to DDR5/HBM production

- Prioritized high-margin products

- Left 40% supply gap instantly

2.Stubborn demand

| Sector | DDR4 Usage | Replacement Difficulty |

|---|---|---|

| Budget phones | 82% | High (cost-sensitive) |

| Car systems | 79% | Medium (long cycles) |

| Factory IoT | 91% | Very High (legacy) |

3.Taiwanese expansion

Unlike global players, Nanya and Winbond added capacity:

- Building two new DDR4 fabs

- Targeting 15% market share

- Extending old node lifespan

This explains why your procurement team struggles to lock in stable DDR4 quotes.

NAND Kicks Off a New Round of Price Hikes?

SanDisk announced a 10%+ price increase in early September. Other major NAND suppliers, including Micron, are expected to follow — Micron has already indicated 20-30% hikes for some products.

The NAND turnaround involves strategic shifts:

Profit First Strategy

- SanDisk accepted 15% shipment drop

- Micron paused quotes entirely

- YMTC delaying expansion plans

Capacity Reallocation

Old vs New Tech Production:

| Generation | 2024 Allocation | 2025 Allocation | Change |

|---|---|---|---|

| 96L-128L | 38% | 22% | ▼42% |

| 176L-200L | 47% | 53% | ▲13% |

| 232L+ | 15% | 25% | ▲67% |

Market Impacts

- Entry-level SSDs become scarce

- Smartphone makers accepting 256GB minimum

- Industrial clients prepaying for supply

This explains why your storage component RFQs get rejected daily.

AI and Seasonal Demand Fuel Market Growth?

Each AI server consumes roughly eight times the DRAM of a normal server.

AI datacenters consume memory disproportionately. HBM and DRAM allocations are heavily prioritized for AI workloads, leaving limited supply for other applications.

The AI effect breaks traditional models:

Demand Multipliers

1.Training Clusters

- 10,000+ GPUs per installation

- 6-month lead times common

- Priority allocation enforced

2.Inference Nodes

- Smaller but more numerous

- Constant hardware refreshes

- Local memory caching

Capacity Hierarchy

| Tier | Users | Allocation Priority |

|---|---|---|

| 1 | AI | 100% guaranteed |

| 2 | Cloud | 60-80% fulfilled |

| 3 | PC | 30-50% fulfilled |

| 4 | Others | <20% fulfilled |

This explains why non-AI projects face memory shortages until 2027.

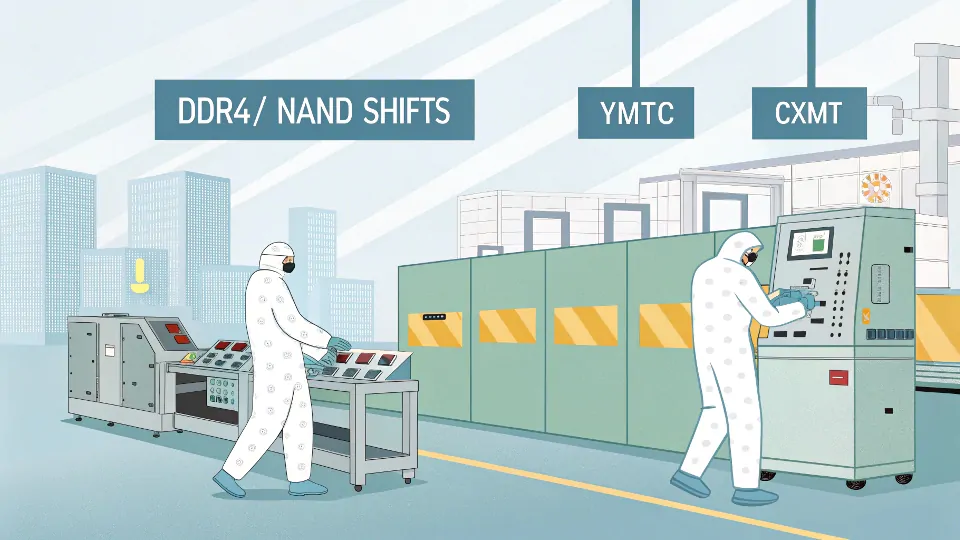

HBM and Chinese Suppliers in the Spotlight?

SK Hynix's HBM sold out until 2026. Chinese makers see their chance.

HBM production requires advanced packaging China lacks. But DDR4/NAND shifts give YMTC and CXMT growth opportunities amid shortages.

The geopolitical dimension adds complexity:

HBM Challenges

- TSMC/Samsung control 94% of TSV capacity

- Even Micron relies on others' packaging

- New HBM4 needs EUV lithography

China's Alternatives

| Strategy | Progress | Limitations |

|---|---|---|

| DDR4 focus | Successful (YMTC) | Legacy tech |

| HBM research | Lab samples only | No mass production |

| Equipment improvement | 28nm achieved | several years behind global leaders |

This explains why:

- US restricts HBM tools to China

- Chinese fabs stockpile DDR4 equipment

- Secondary market DDR4 equipment prices have surged sharply due to supply shortages.

Conclusion

Memory markets transformed permanently. DDR4 shortages compound as NAND joins the upcycle. AI demand dominates allocations through 2026. Adapt procurement strategies now.

You may also be interested in:

How to Avoid Common Mistakes When Wholesaling Game Consoles?

Sourcing game consoles in bulk can be profitable, but many dealers lose money due to avoidable errors. Let me share how to sidestep these pitfalls.

Games Consoles Wholesale Guide: How to Choose the Best Suppliers in 2025

The gaming industry is booming, and picking the right supplier can make or break your business. Don't fall for cheap traps. Quality matters more in

Where Can I Buy Retro Handheld Game Consoles Wholesale?

Looking for reliable wholesale retro handheld consoles? The market is flooded with options, but quality varies. Avoid cheap imitations and unstable supply chains—your business deserves

Is a Video Game Console the Best Gift for the New Year?

Phones replaced conversations during holidays. Game consoles bring families together again. Laughter fills the room as players compete on shared screens. Modern game consoles reconnect

Is it bad to give your child a game console as a gift?

Many parents worry about buying game consoles for kids. They fear it might harm their development. But is this fear justified? Let us explore the

Offline Game Console Sales in 2025: Why Brick-and-Mortar Still Matters

Introduction While online sales are projected to account for 52.7% of global gaming console purchases in 2025, offline retail remains indispensable—especially for hands-on experiences, instant